THE

GOLD STANDARD - A

system of comparable security for goods to the value of, relies on goods

being valued at the right level. At the moment there are too many

pretend paper notes in circulation, with literally nothing to back up

any value whatsoever. In a world threatened by global warming, food is

the only commodity worth comparing with.

That

value needs to be tied to the maximum sustainable yield of planet earth,

divided by what a person needs to be healthy. So giving us the potential

safe world population. Gold and silver is useless when you are starving

to death, as are luxury mansions and civic halls.

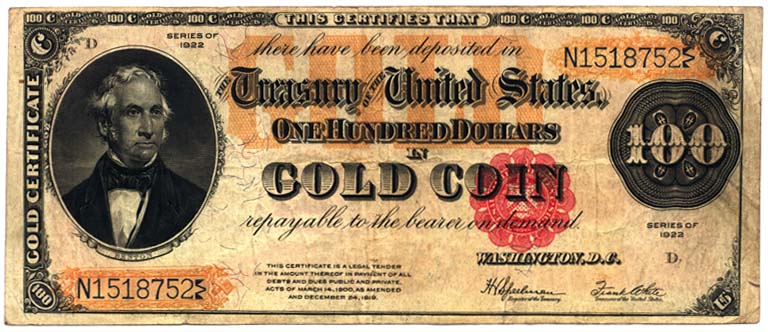

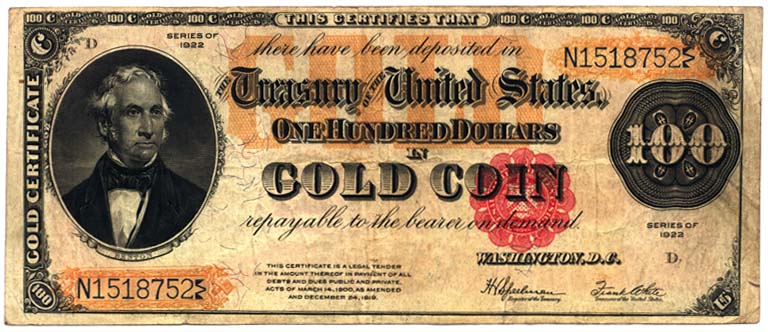

The gold

specie standard is a monetary system in which paper money is freely convertible into a fixed amount of gold. In other words, in such a monetary system, gold backs the value of money.

The gold standard was widely used in the 19th and early part of the 20th century. Most nations abandoned the gold standard as the basis of their monetary systems at some point in the 20th century, although many still hold substantial

gold reserves.

With the invention and spread in use of paper money, gold coins were eventually supplanted by banknotes, creating the gold bullion standard, a system in which gold coins do not circulate, but the authorities agree to sell gold bullion on demand at a fixed price in exchange for the circulating currency.

A

BIT OF HISTORY

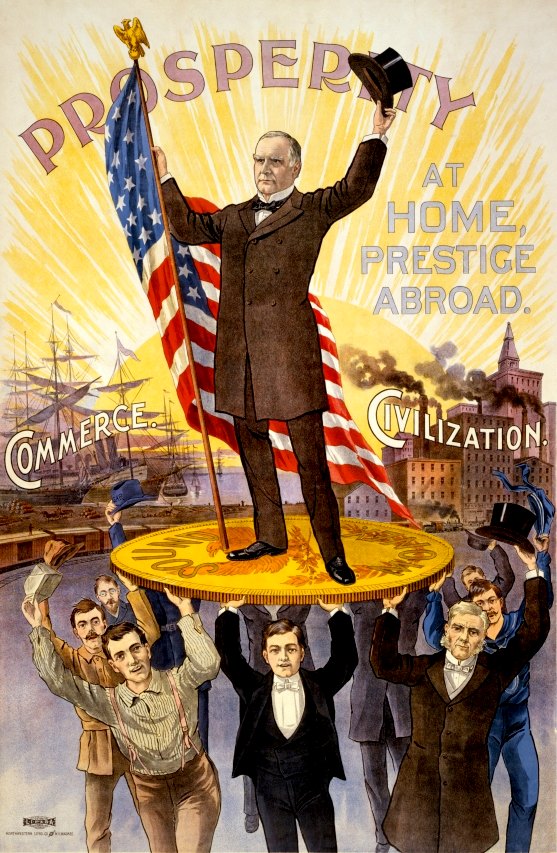

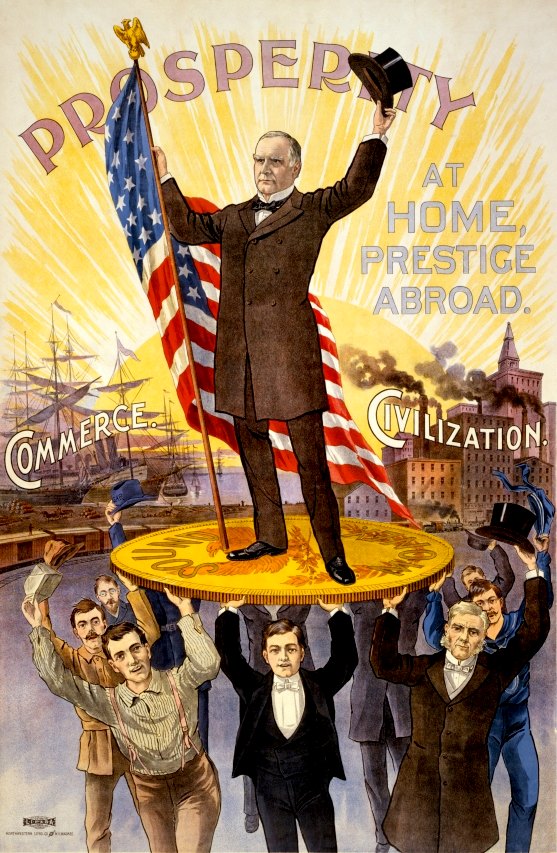

"We have gold because we cannot trust governments,"

President Herbert Hoover famously said in 1933 in his statement to Franklin D. Roosevelt. The Emergency Banking Act, forced all Americans to convert their gold coins, bullion, and certificates into U.S. dollars, to stop the outflow of gold reserves during the Great Depression. The writing was on the wall, but nobody could read it.

Around 700 B.C., gold was made into coins for the first time, enhancing its usability as a monetary unit. Before this, gold had to be weighed and checked for purity when settling trades.

Gold coins were not a perfect solution, since a common practice for centuries to come was to clip these slightly irregular coins to accumulate enough gold that could be melted down into

bullion, something akin to bank and Paypal charges. In 1696, the Great Recoinage in England introduced a technology that automated the production of coins

with ridged rims, putting an end to clipping.

Since Governments could not always rely on additional supplies from

mines, the supply of gold expanded only through deflation, trade, or pillage.

The first great gold rush came to America in the 15th century. Spain's plunder of treasures from the New World raised Europe's supply of gold times fives in the 16th century. Queen Elizabeth pirated much of this gold

from Spain for

England, using her SeaHawk privateers, of which Sir Walter Raleigh was

one. So theft upon theft.

In modern times, the British West Indies was one of the first regions to adopt a gold specie standard. Following Queen Anne's proclamation of 1704, the British West Indies gold standard was a de facto gold standard based on the Spanish gold doubloon. In 1717, Sir Isaac Newton, the master of the Royal Mint, established a new mint ratio between silver and gold that had the effect of driving silver out of circulation and putting Britain on a gold standard.

A formal gold specie standard was first established in 1821, when Britain adopted it following the introduction of the gold sovereign by the new Royal Mint at Tower Hill in 1816. The Province of Canada in 1854, Newfoundland in 1865, and the United States and Germany (de jure) in 1873 adopted gold. The United States used the eagle as its unit, Germany introduced the new gold mark, while Canada adopted a dual system based on both the American gold eagle and the British gold sovereign.

In 1844, the Bank Charter Act established that Bank of England notes were fully backed by gold and they became the legal standard. According to the strict interpretation of the gold standard, this 1844 act marked the establishment of a full gold standard for British money.

Australia and New Zealand adopted the British gold standard. Royal Mint branches were established in Sydney, Melbourne, and Perth for the purpose of minting gold sovereigns from Australia's rich gold deposits.

The gold specie standard came to an end in the United Kingdom and the rest of the British Empire with the outbreak of World War I. In financing the war and abandoning gold, many of the belligerents suffered drastic inflations. Price levels doubled in the U.S. and Britain, tripled in France and quadrupled in Italy. Exchange rates changed less, even though European inflations were more severe than America's.

The end of the gold standard was successfully effected by the Bank of England through appeals to patriotism urging citizens not to redeem paper money for gold specie. It was only in 1925, when Britain returned to the gold standard in conjunction with Australia and South Africa, that the gold specie standard was officially ended.

The British Gold Standard Act 1925 both introduced the gold bullion standard and simultaneously repealed the gold specie standard. The new standard ended the circulation of gold specie coins. Instead, the law compelled the authorities to sell gold bullion on demand at a fixed price.

Gold

and silver (metals) standards were interlinked.

Please use our

A-Z INDEX to

navigate this site, or our HOMEPAGE